Financial Statements 30 June 2018

INDEPENDENT AUDITOR’S REPORT

STATEMENT BY THE ACCOUNTABLE AUTHORITY AND CHIEF FINANCIAL OFFICER

In our opinion, the attached financial statements for the year ended 30 June 2018 comply with subsection 42(2) of the Public Governance, Performance and Accountability Act 2013 (PGPA Act), and are based on properly maintained financial records as per subsection 41(2) of the PGPA Act.

In our opinion, at the date of this statement, there are reasonable grounds to believe that the National Capital Authority will be able to pay its debts as and when they fall due.

Terry Weber

Chair

30 August 2018

Coleen Davis

Chief Financial Officer

30 August

2018

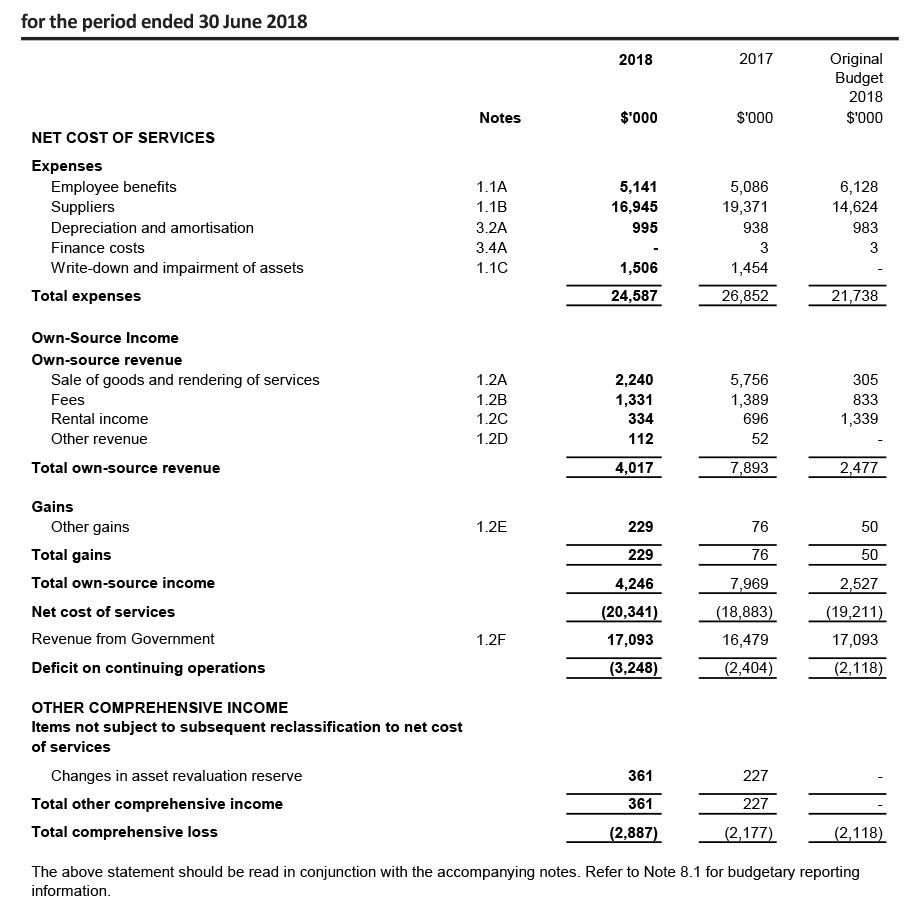

STATEMENT OF COMPREHENSIVE INCOME

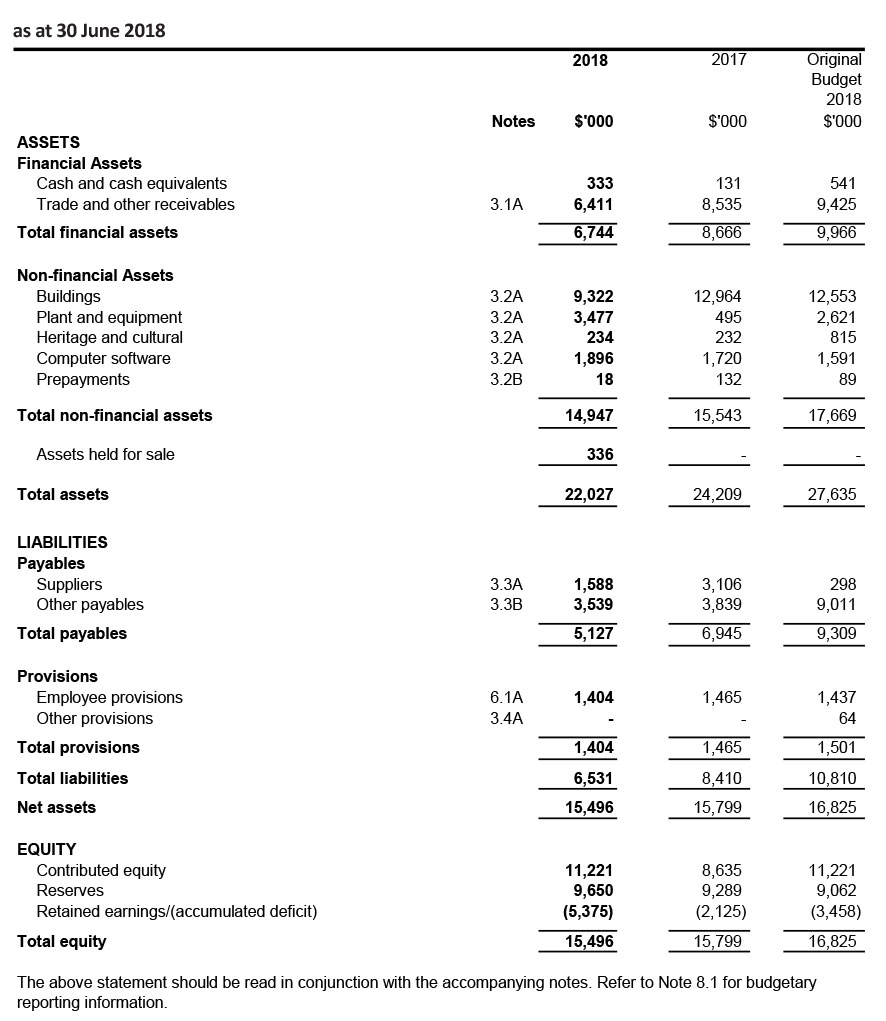

STATEMENT OF FINANCIAL POSITION

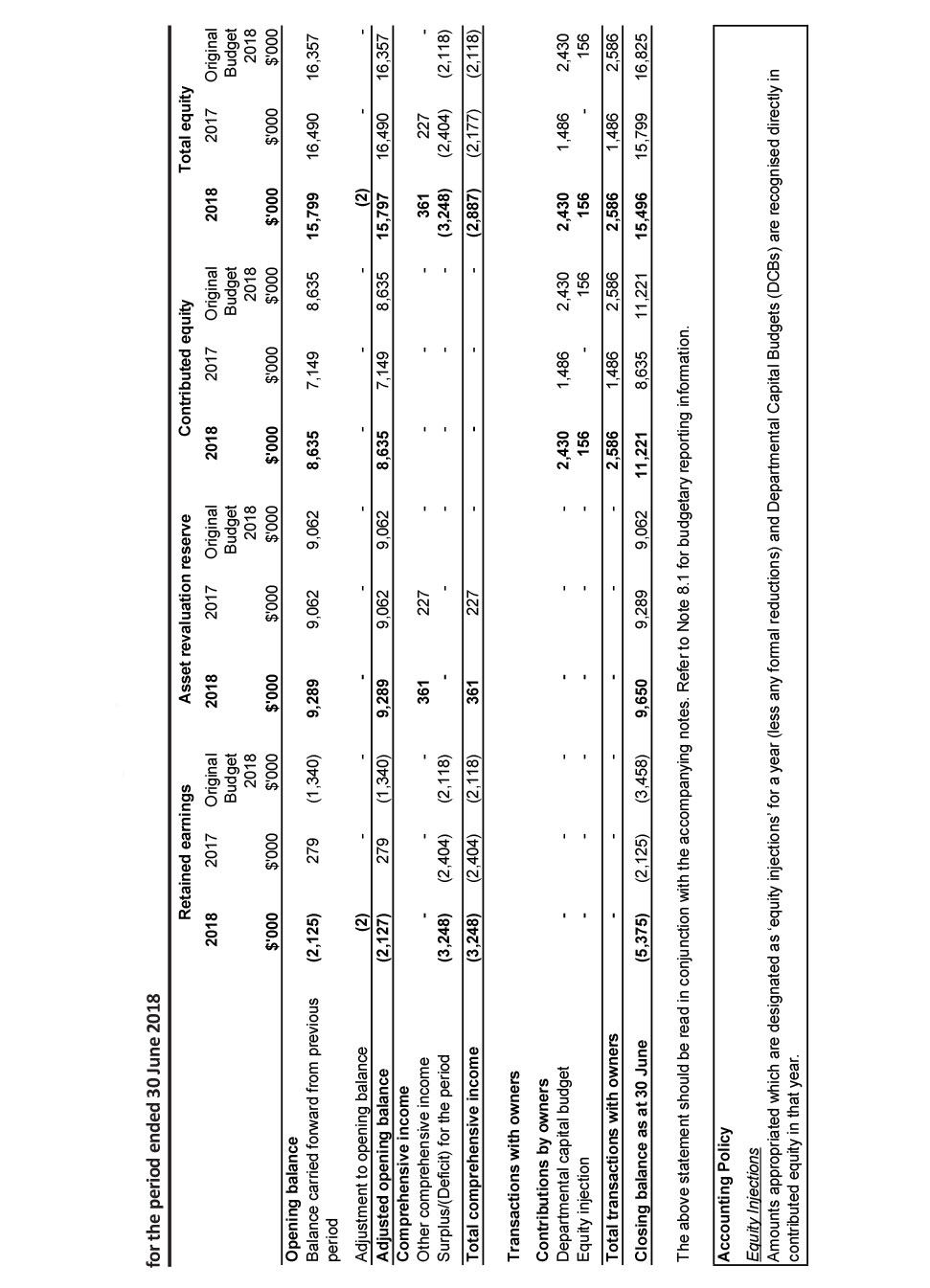

STATEMENT OF CHANGES IN EQUITY

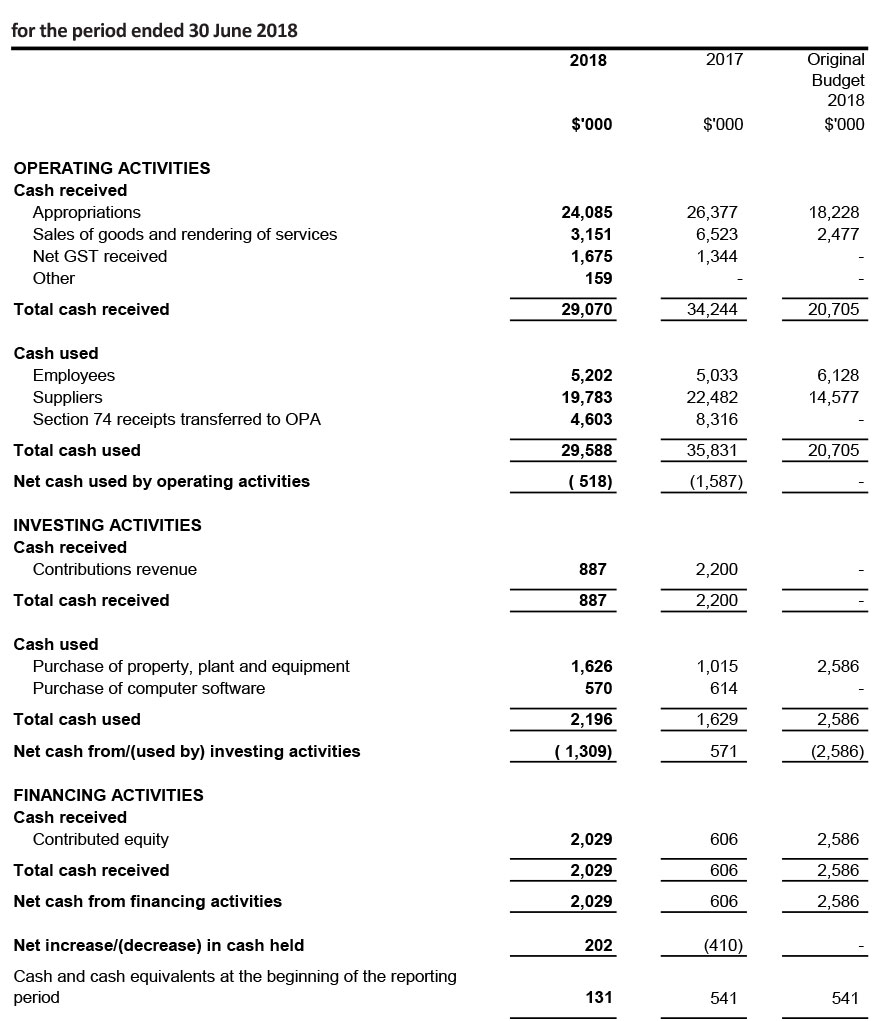

CASH FLOW STATEMENT

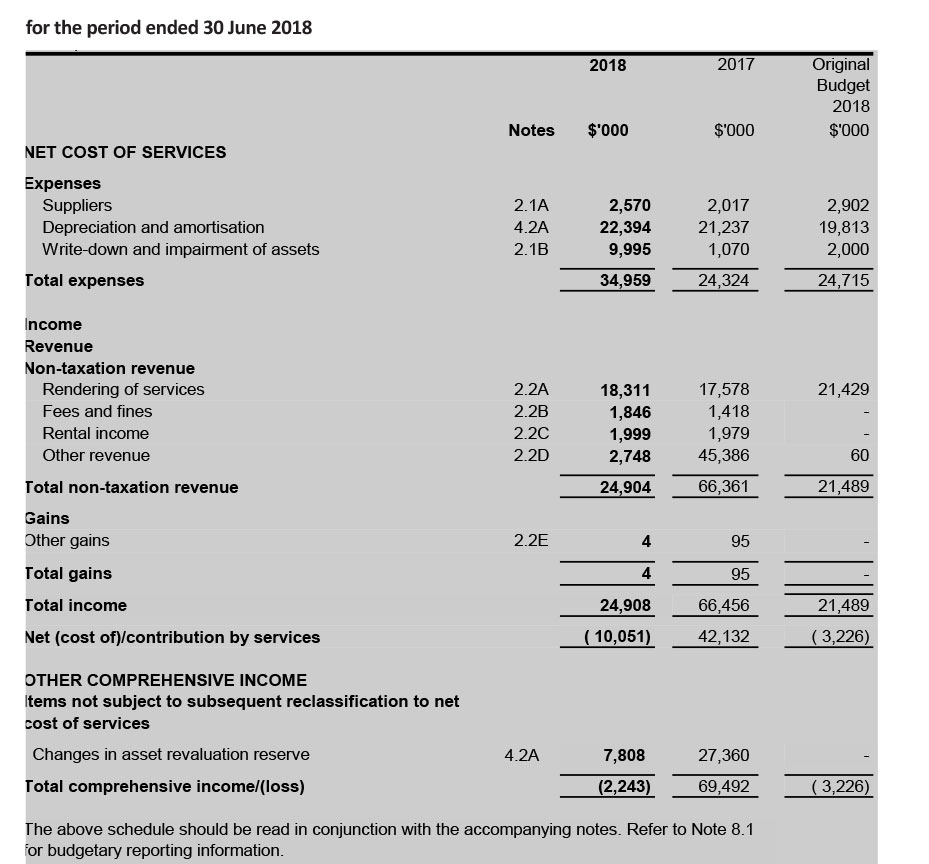

ADMINISTERED SCHEDULE OF COMPREHENSIVE INCOME

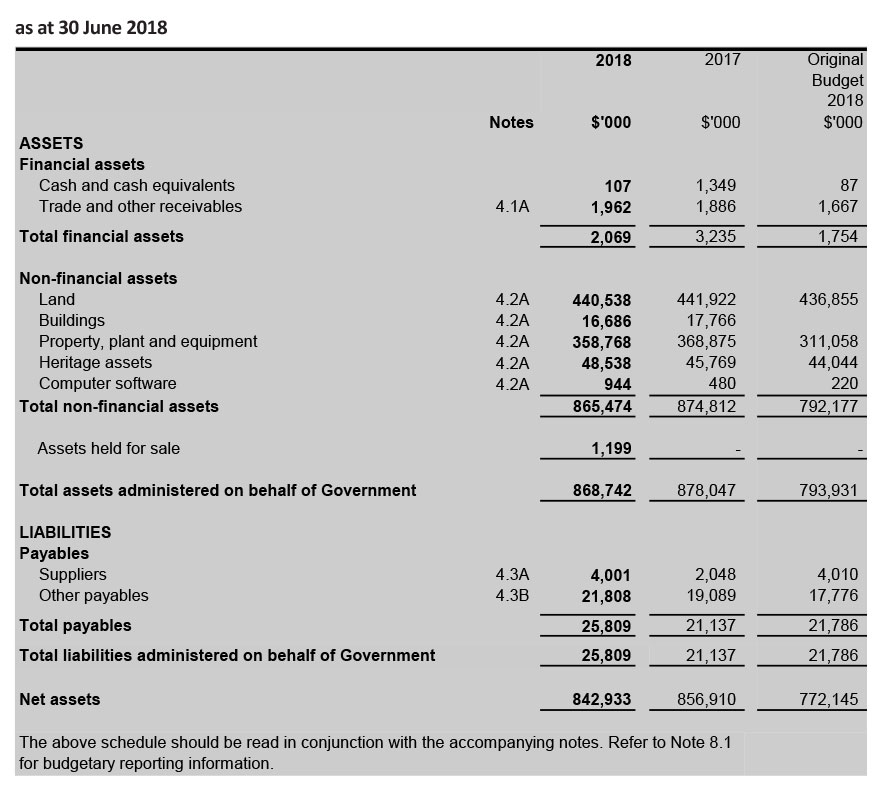

ADMINISTERED SCHEDULE OF ASSETS AND LIABILITIES

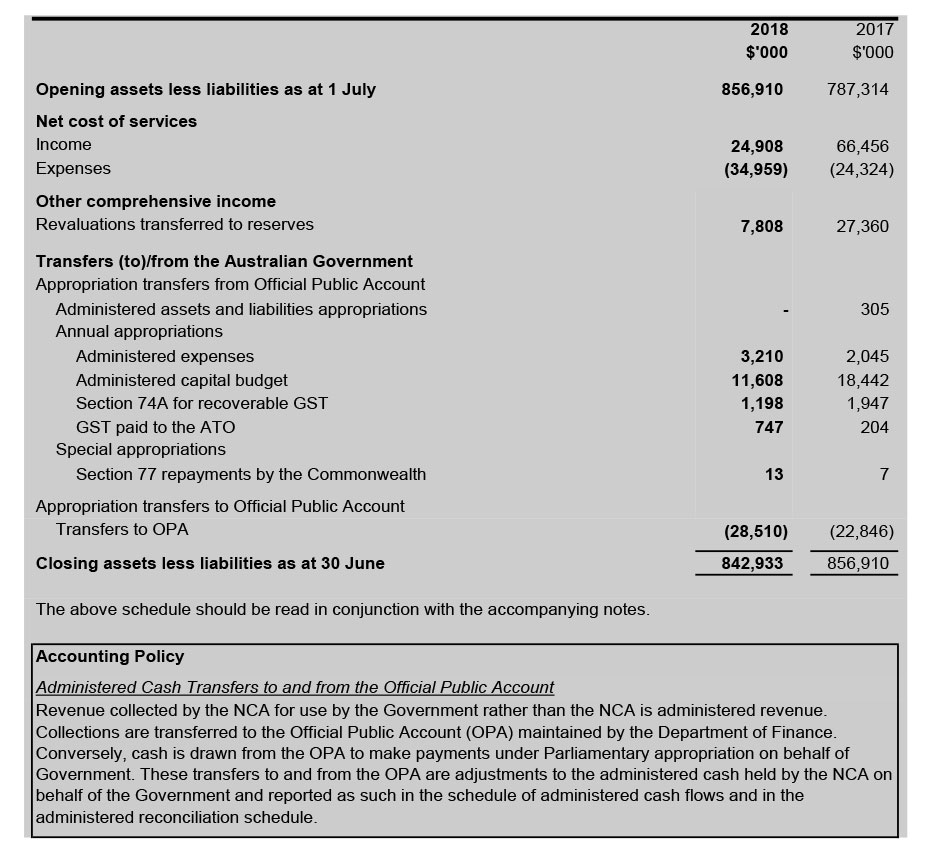

ADMINISTERED RECONCILIATION SCHEDULE

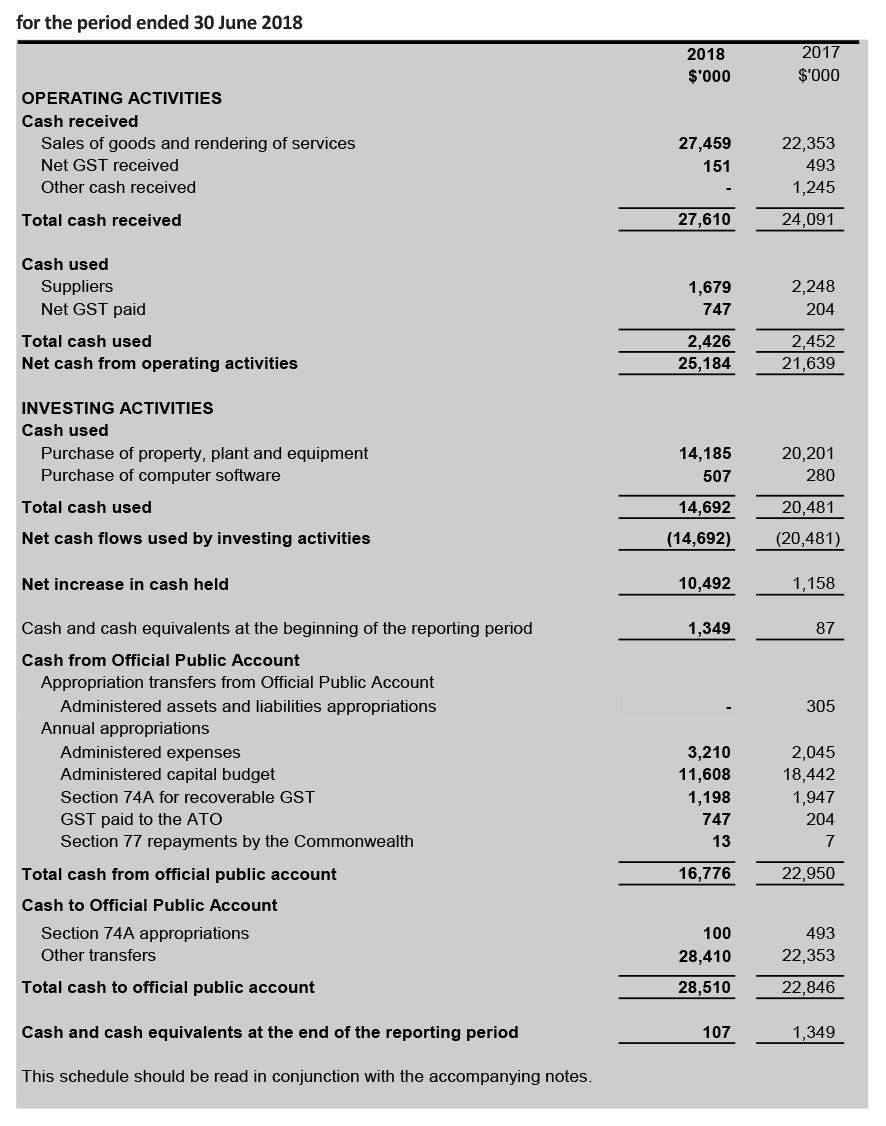

ADMINISTERED CASH FLOW STATEMENT

Notes to and forming part of the Financial Statements

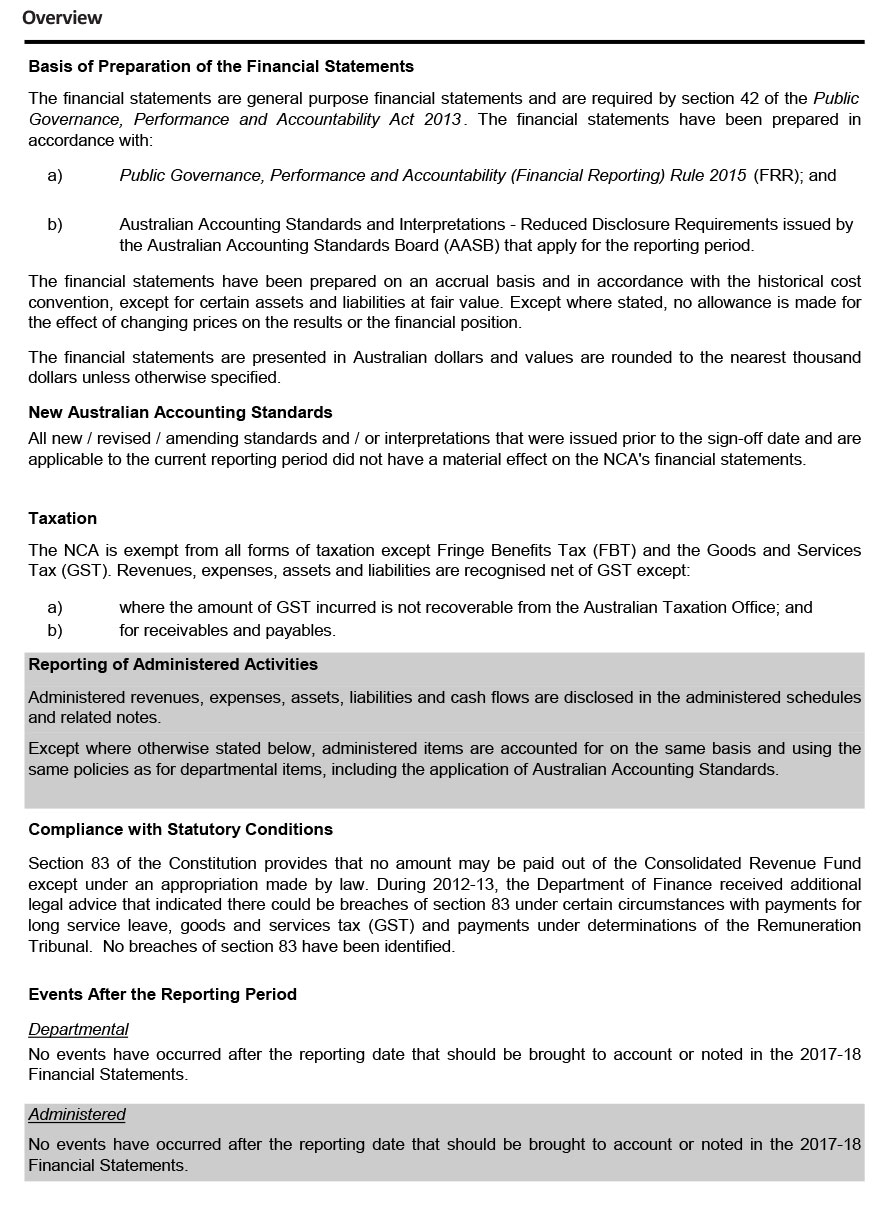

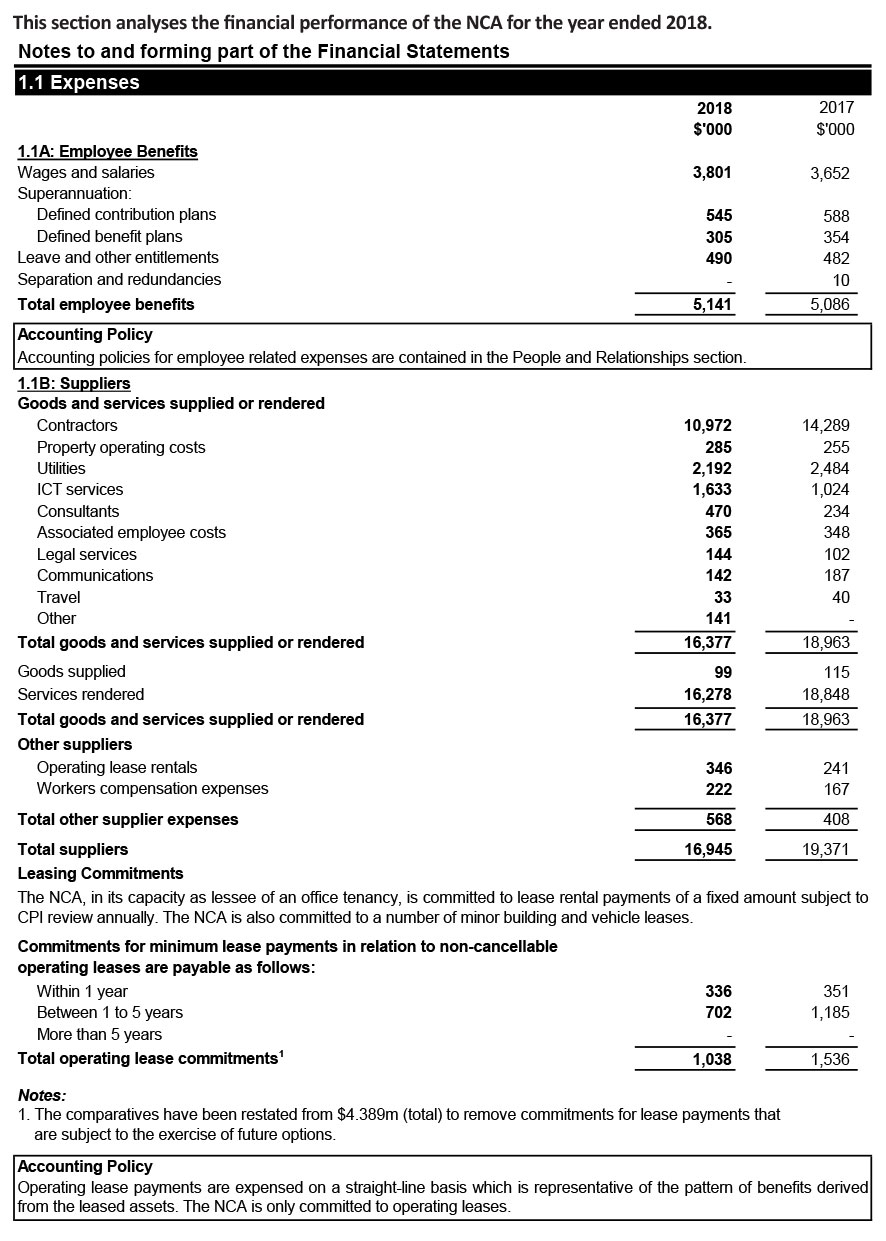

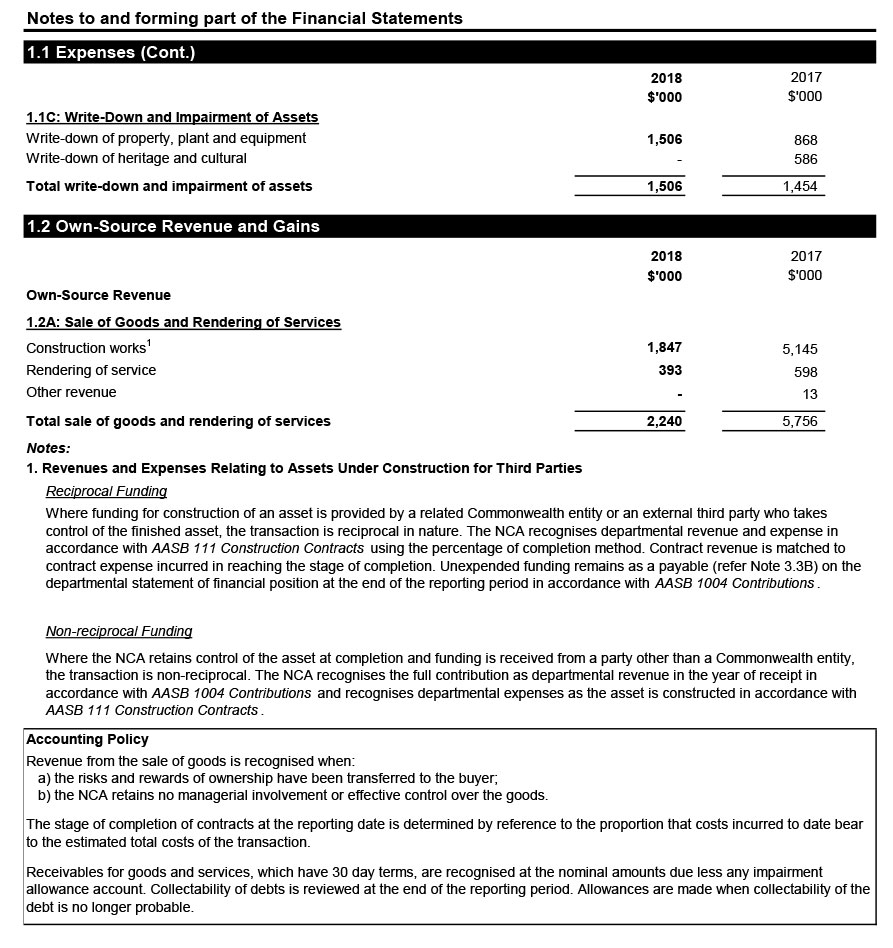

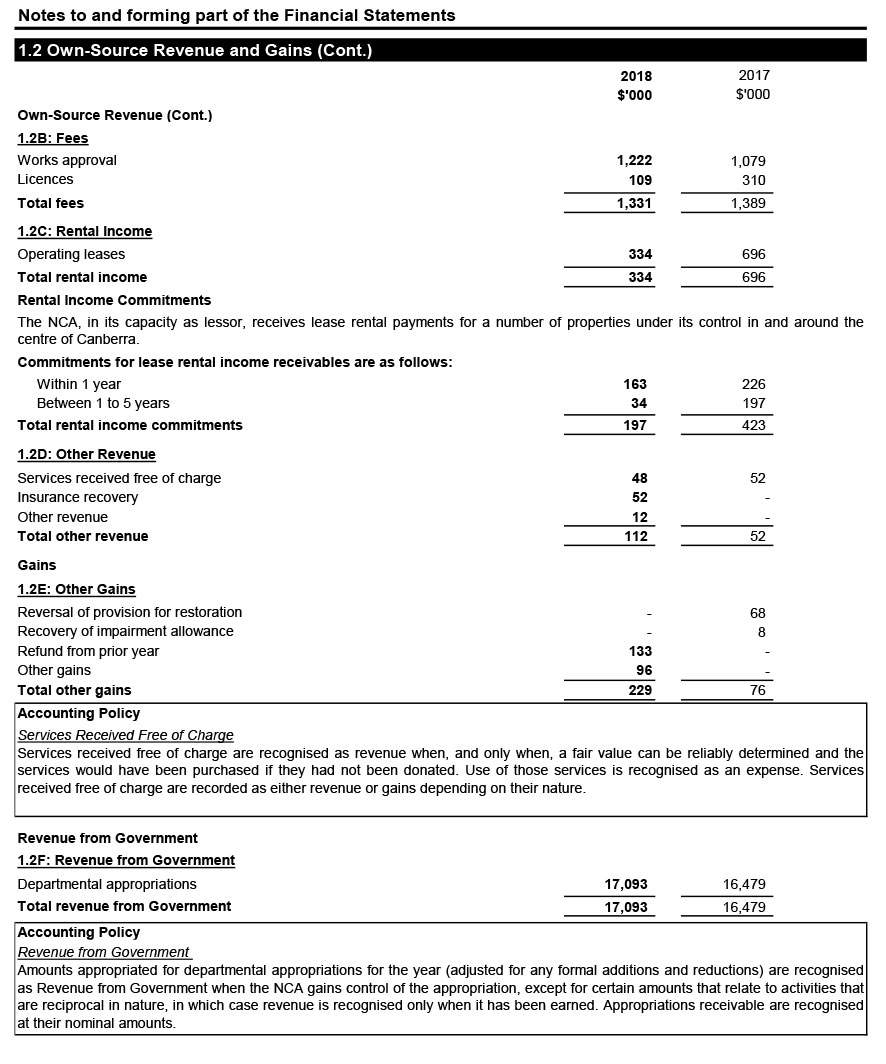

1. Departmental Financial Performance

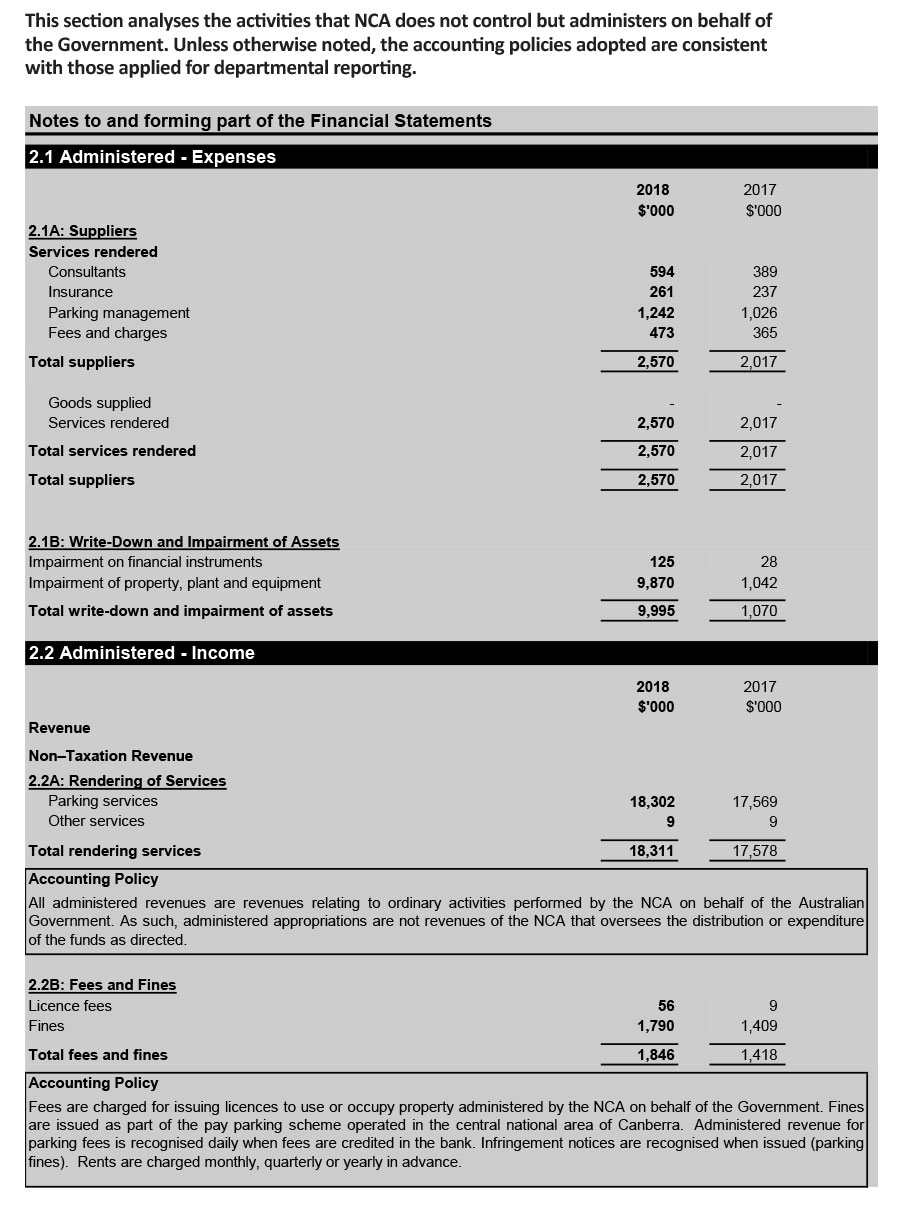

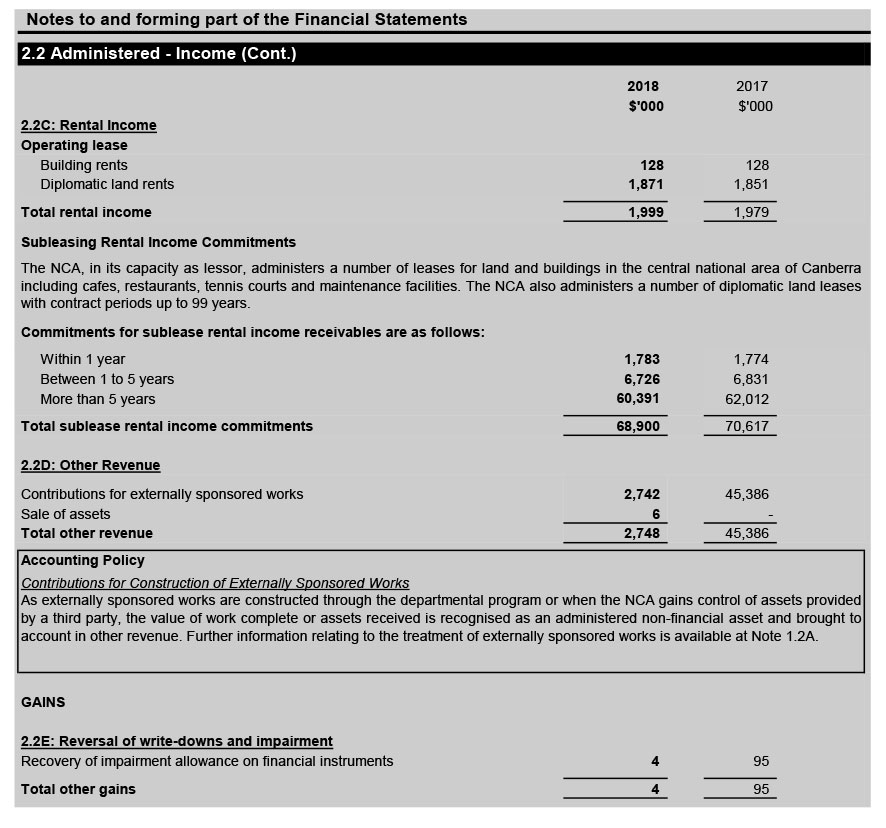

2. Income and Expenses Administered on Behalf of Government

This section analyses the activities that NCA does not control but administers on behalf of the Government. Unless otherwise noted, the accounting policies adopted are consistent with those applied for departmental reporting.

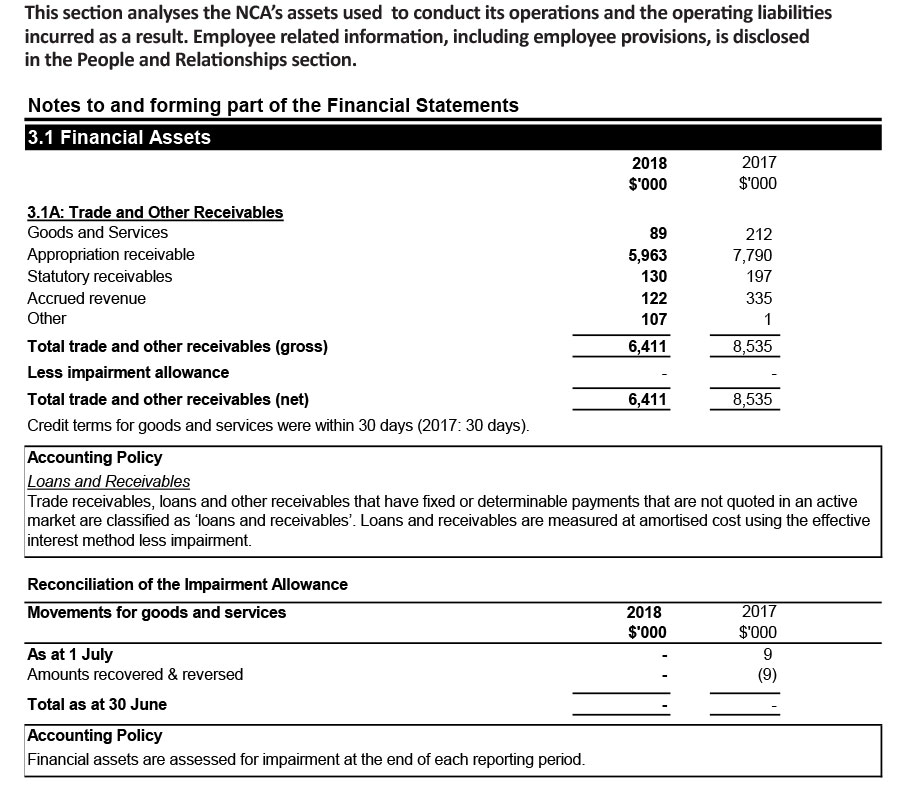

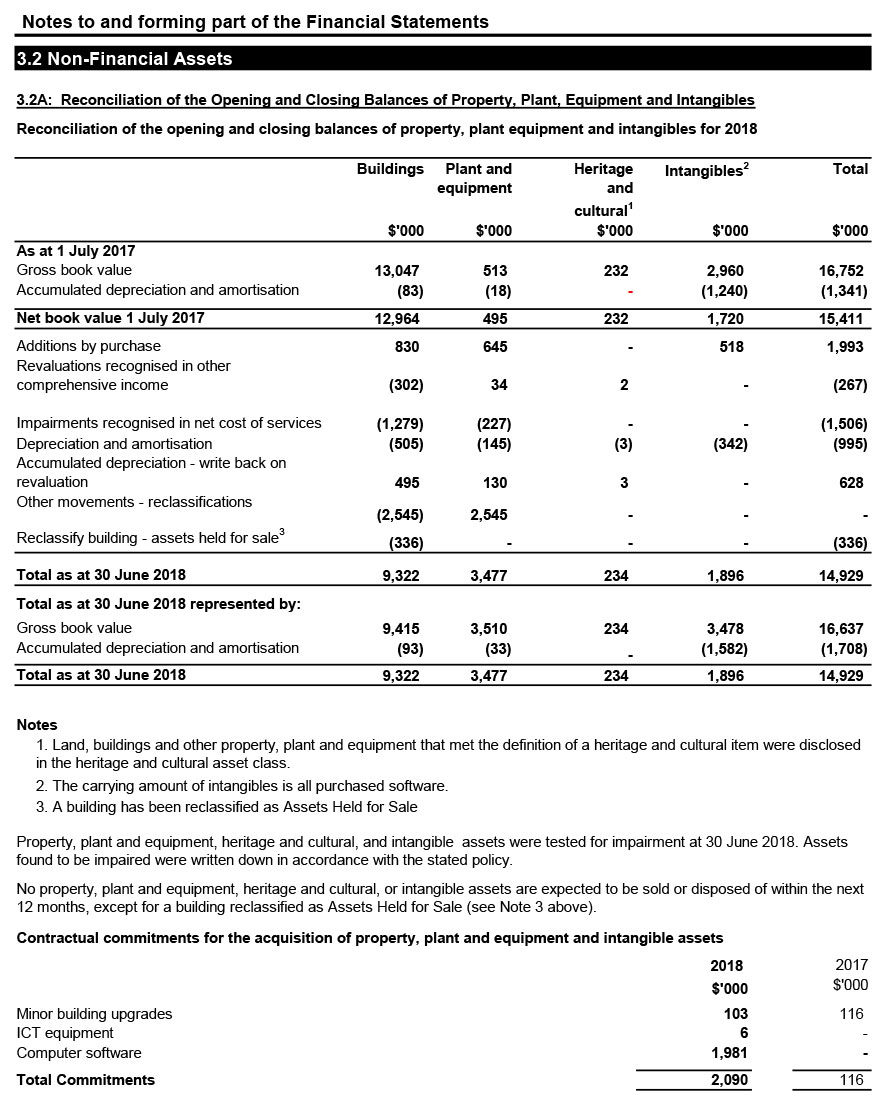

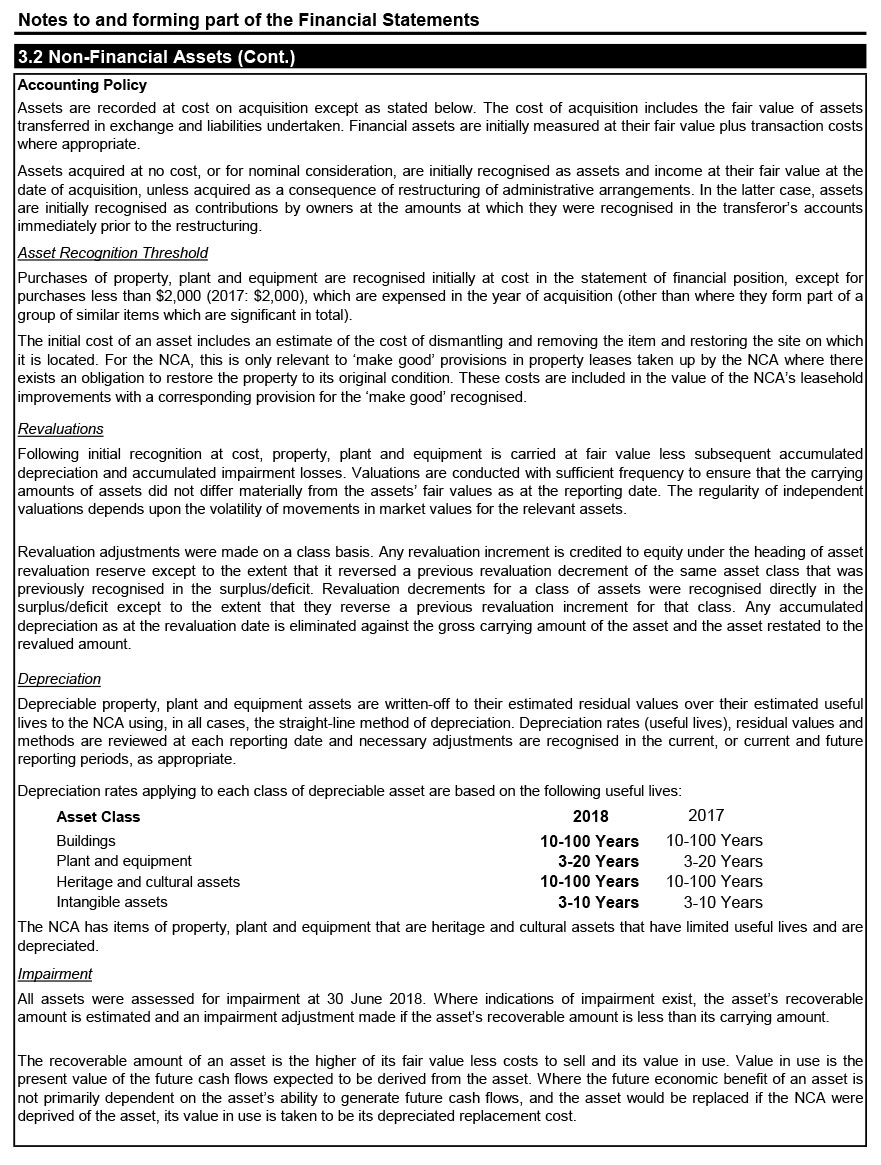

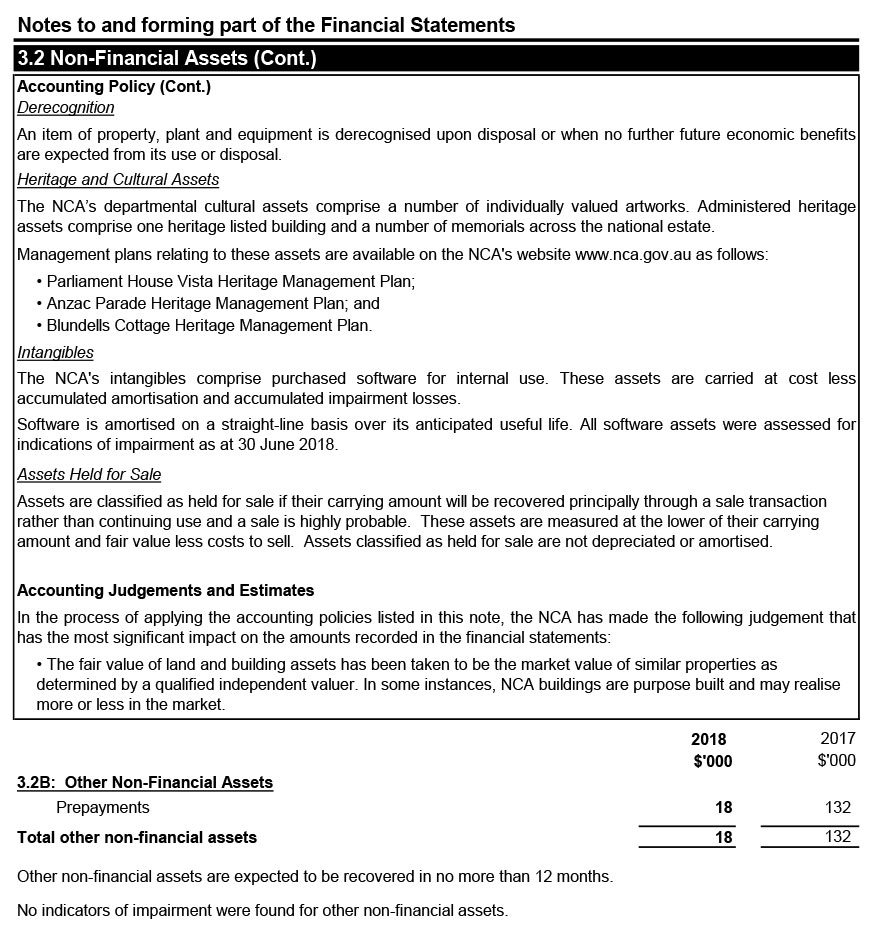

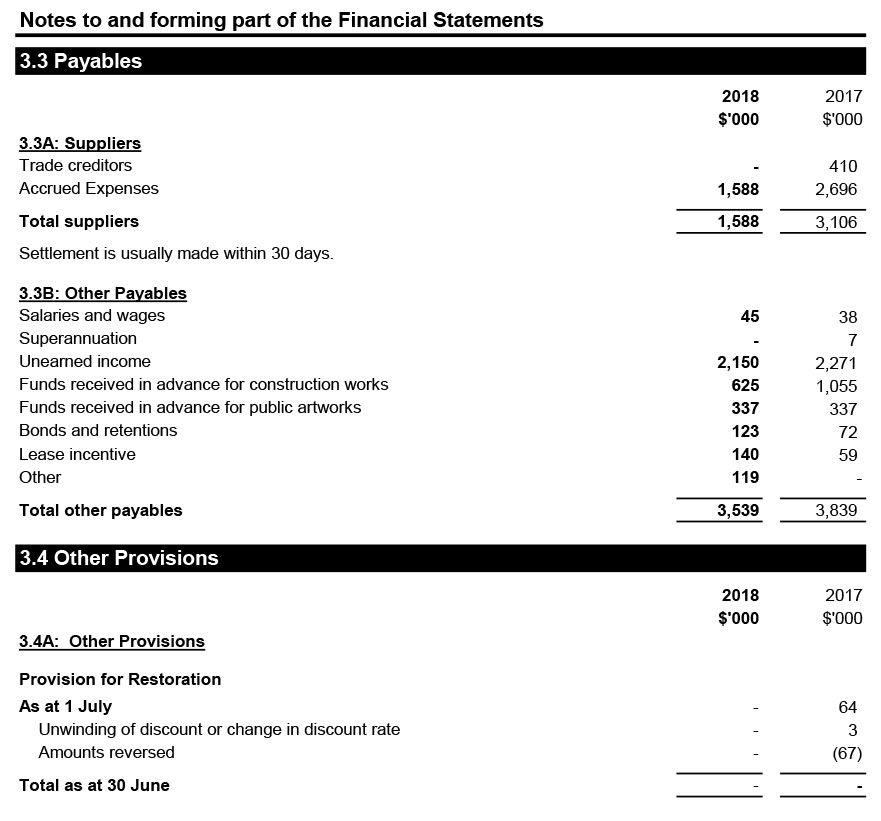

3. Departmental Financial Position

This section analyses the NCA’s assets used to conduct its operations and the operating liabilities incurred as a result. Employee related information, including employee provisions, is disclosed in the People and Relationships section.

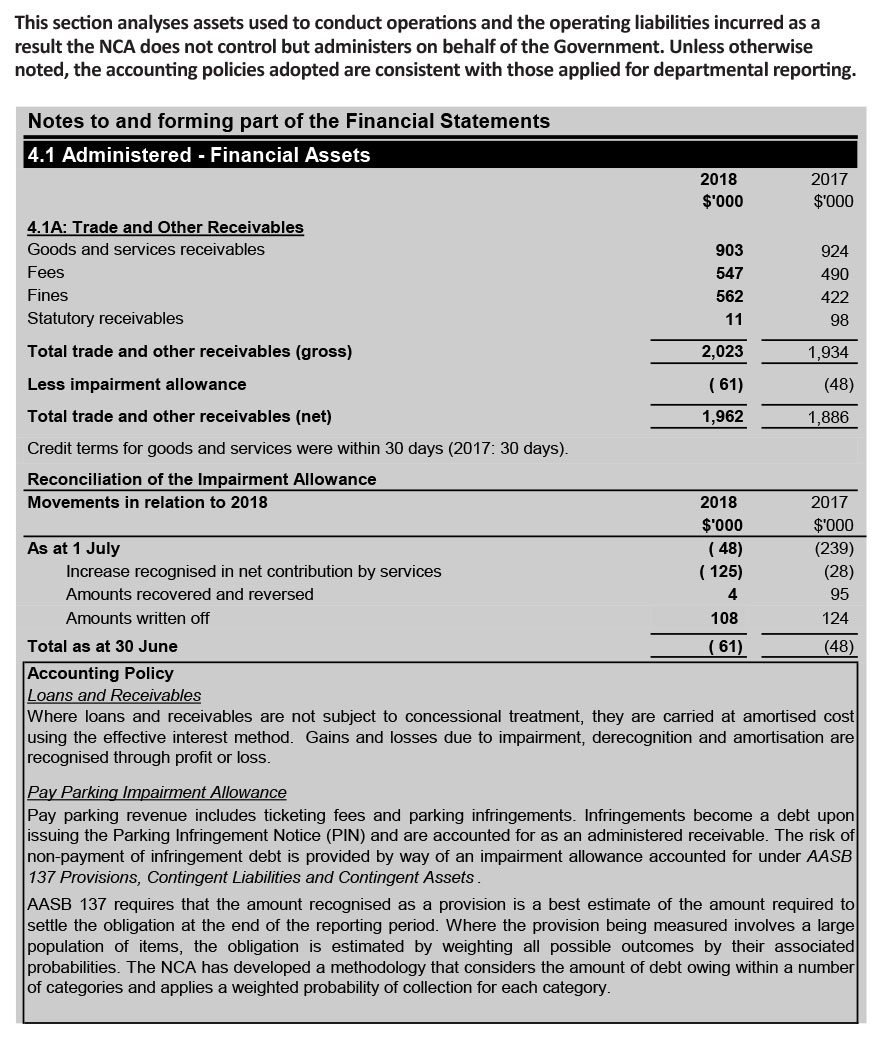

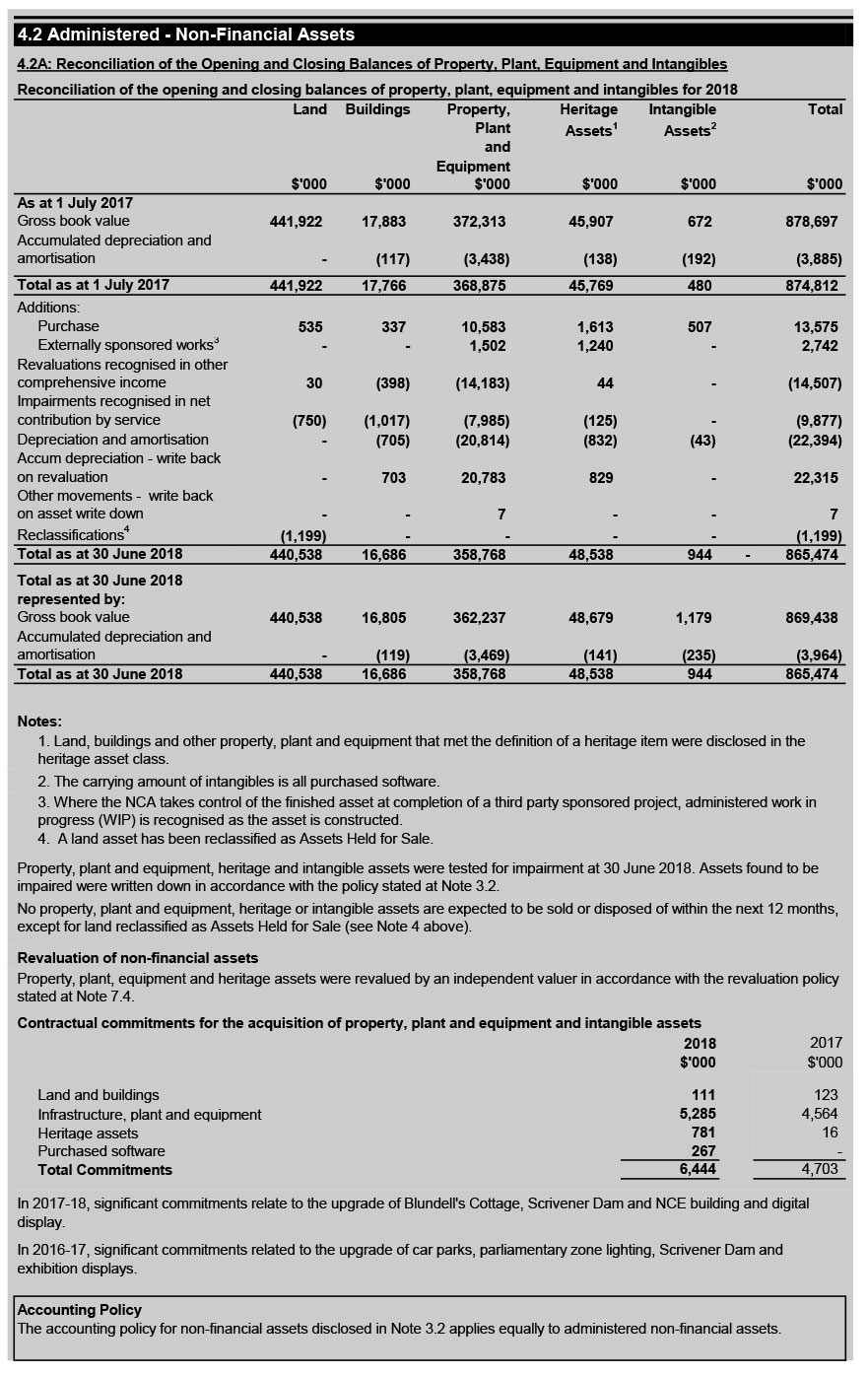

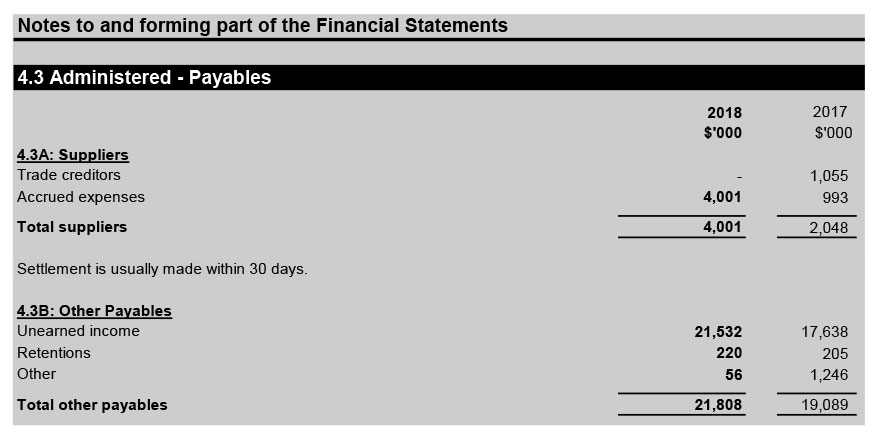

4. Assets and Liabilities Administered on Behalf of Government

This section analyses assets used to conduct operations and the operating liabilities incurred as a result the NCA does not control but administers on behalf of the Government. Unless otherwise noted, the accounting policies adopted are consistent with those applied for departmental reporting.

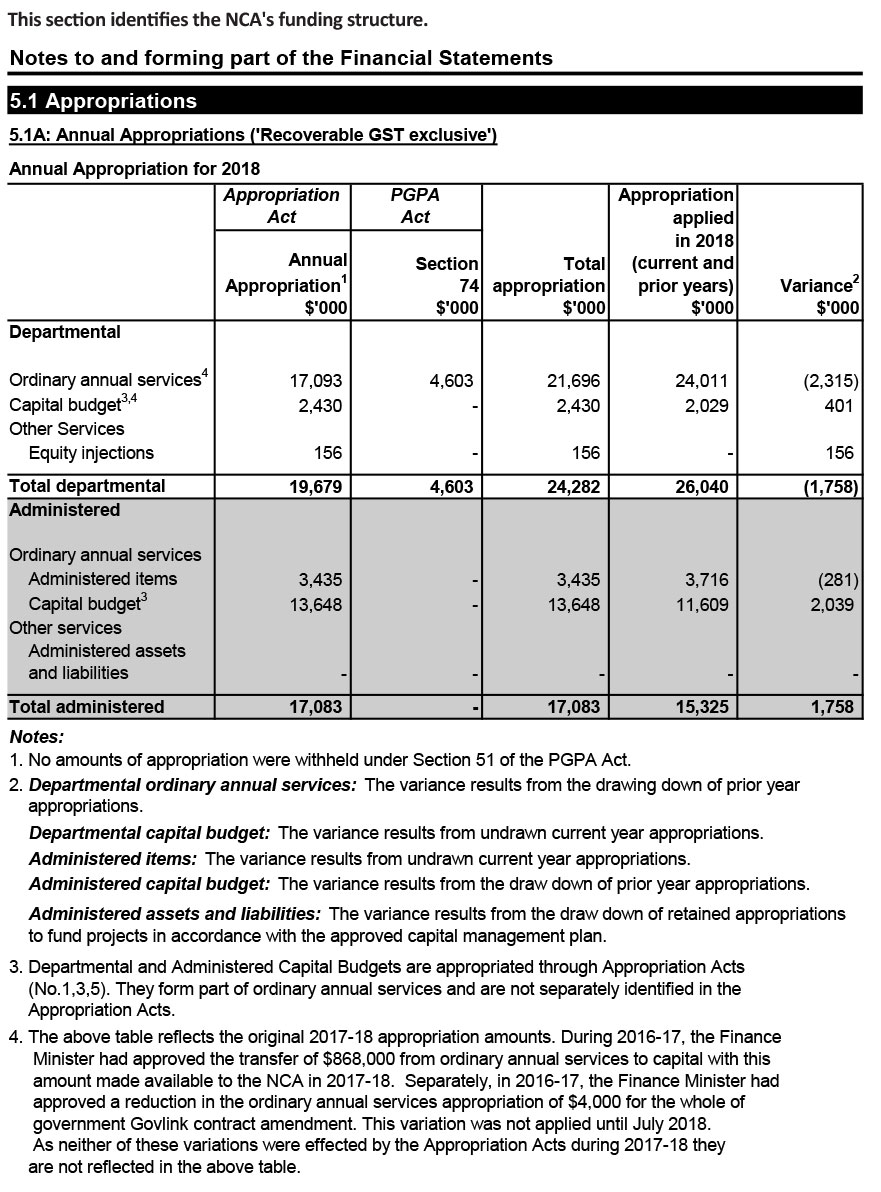

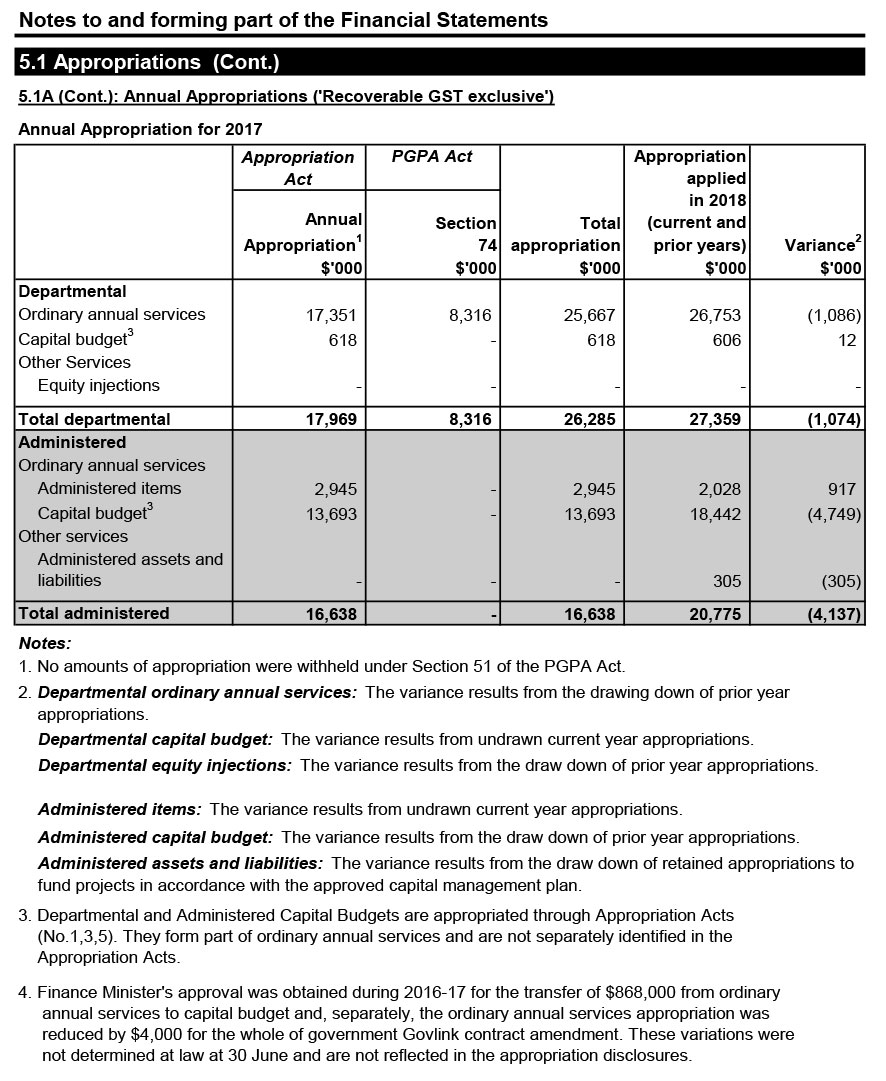

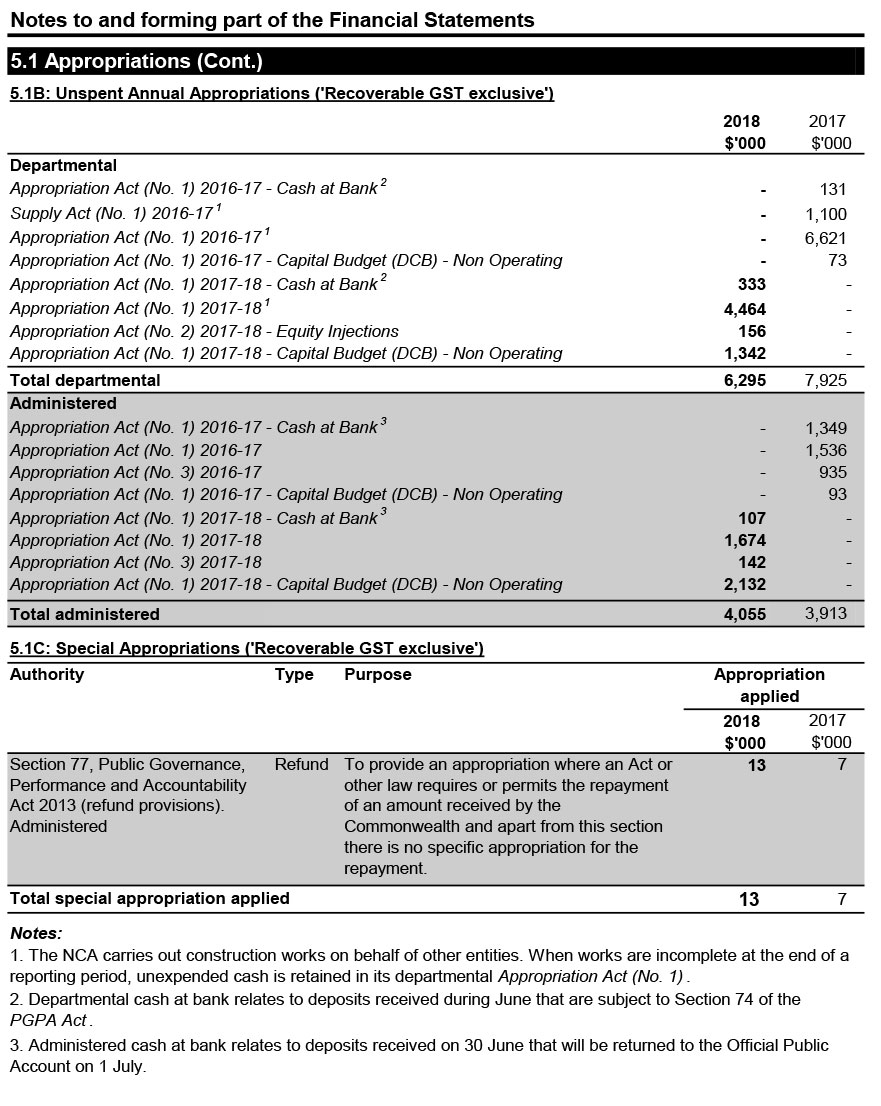

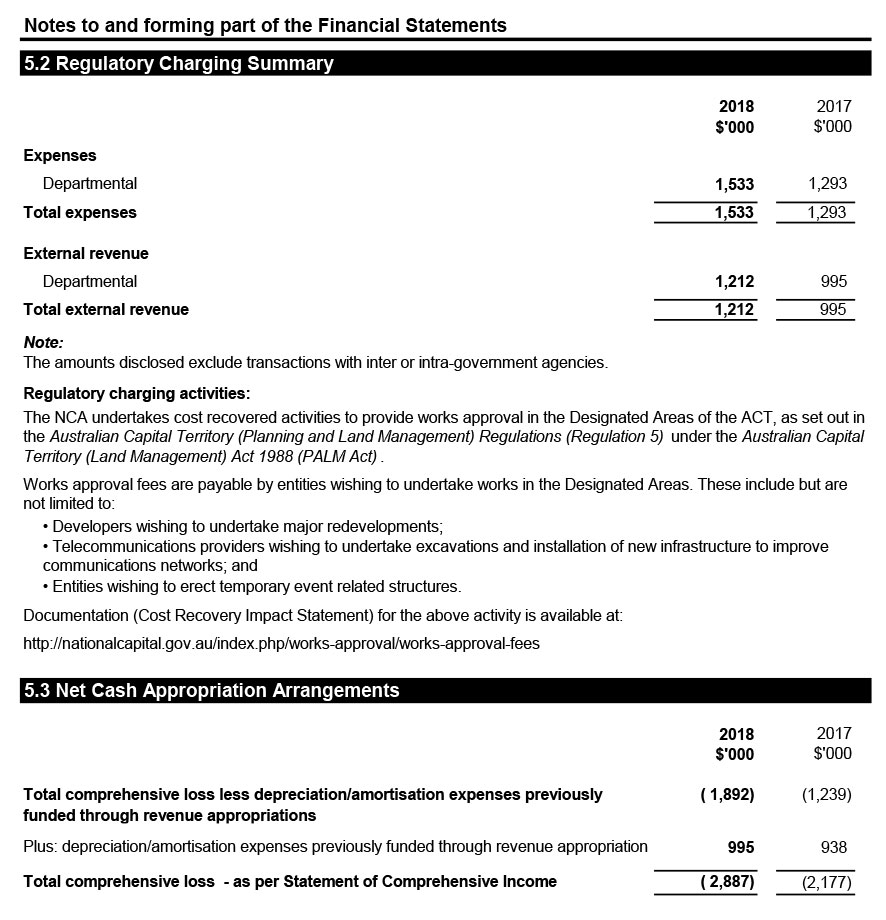

5. Funding

This section identifies the NCA's funding structure.

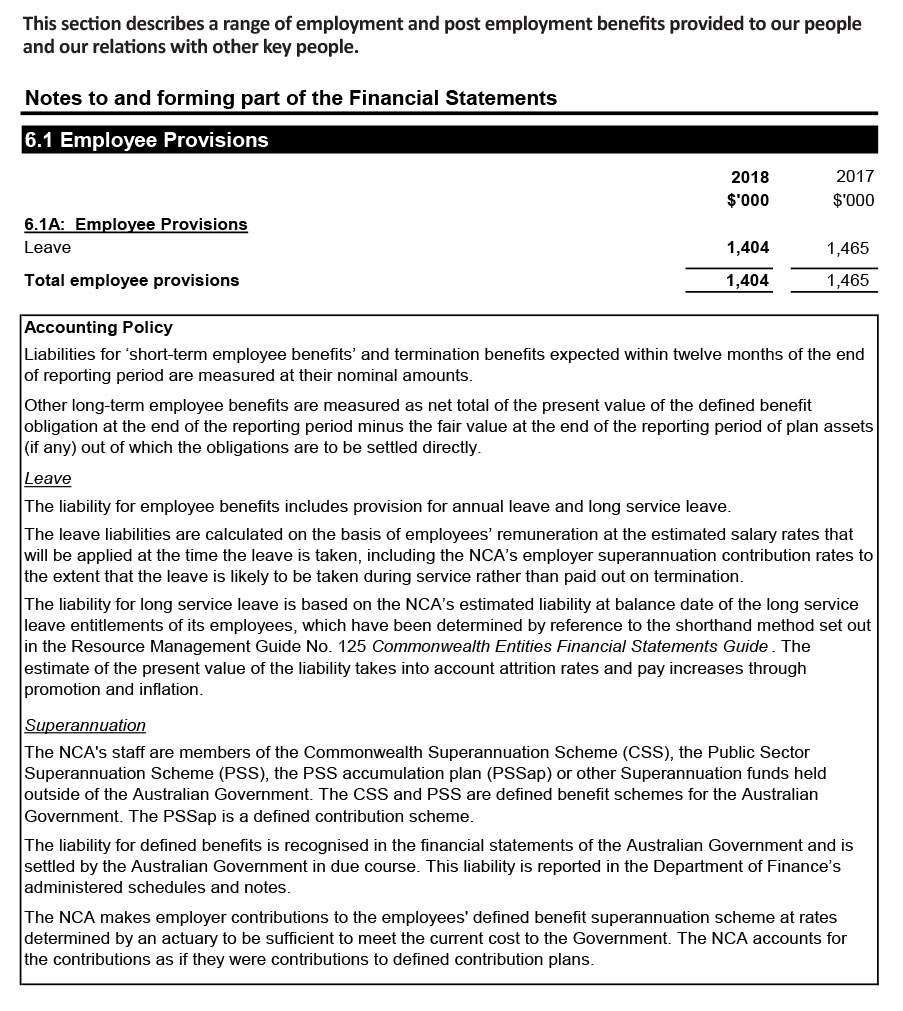

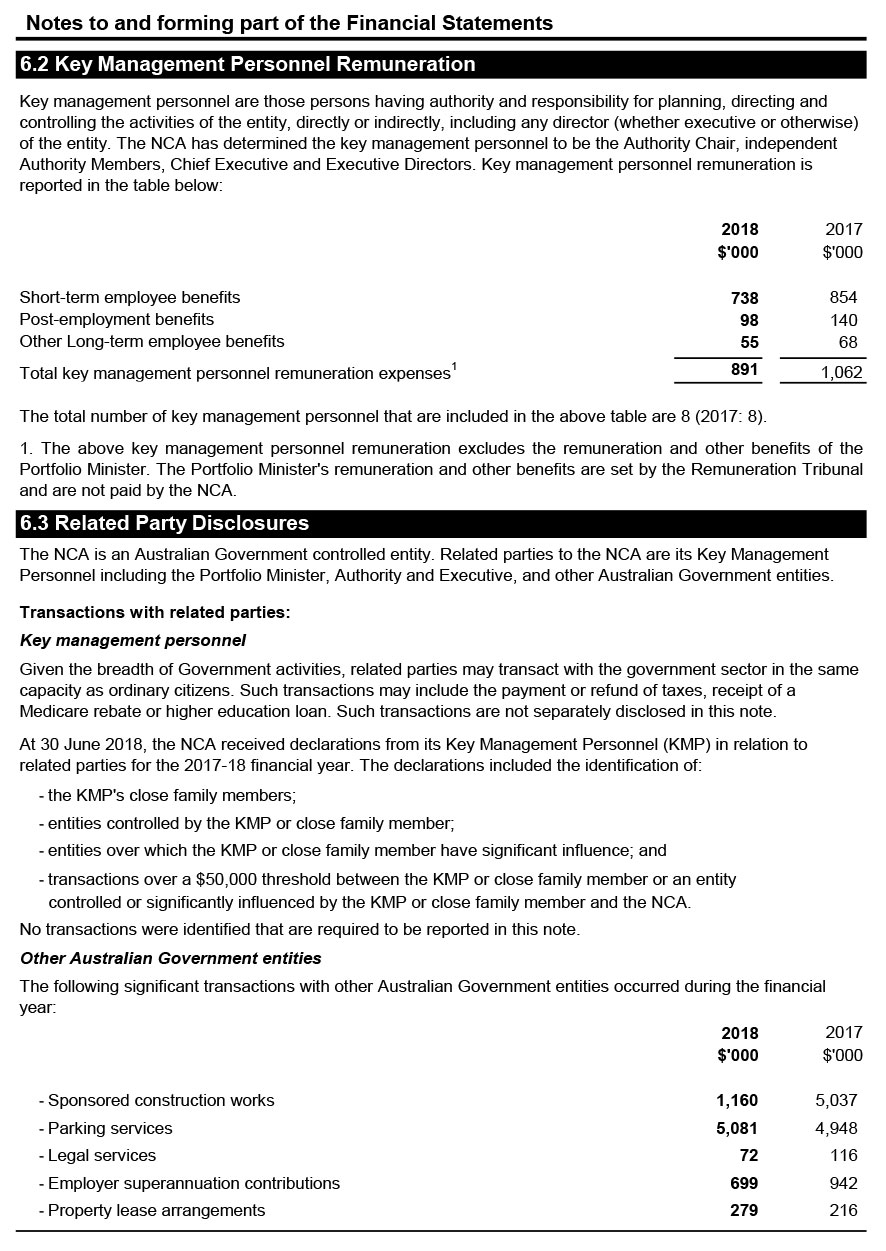

6. People and Relationships

This section describes a range of employment and post employment benefits provided to our people and our relations with other key people.

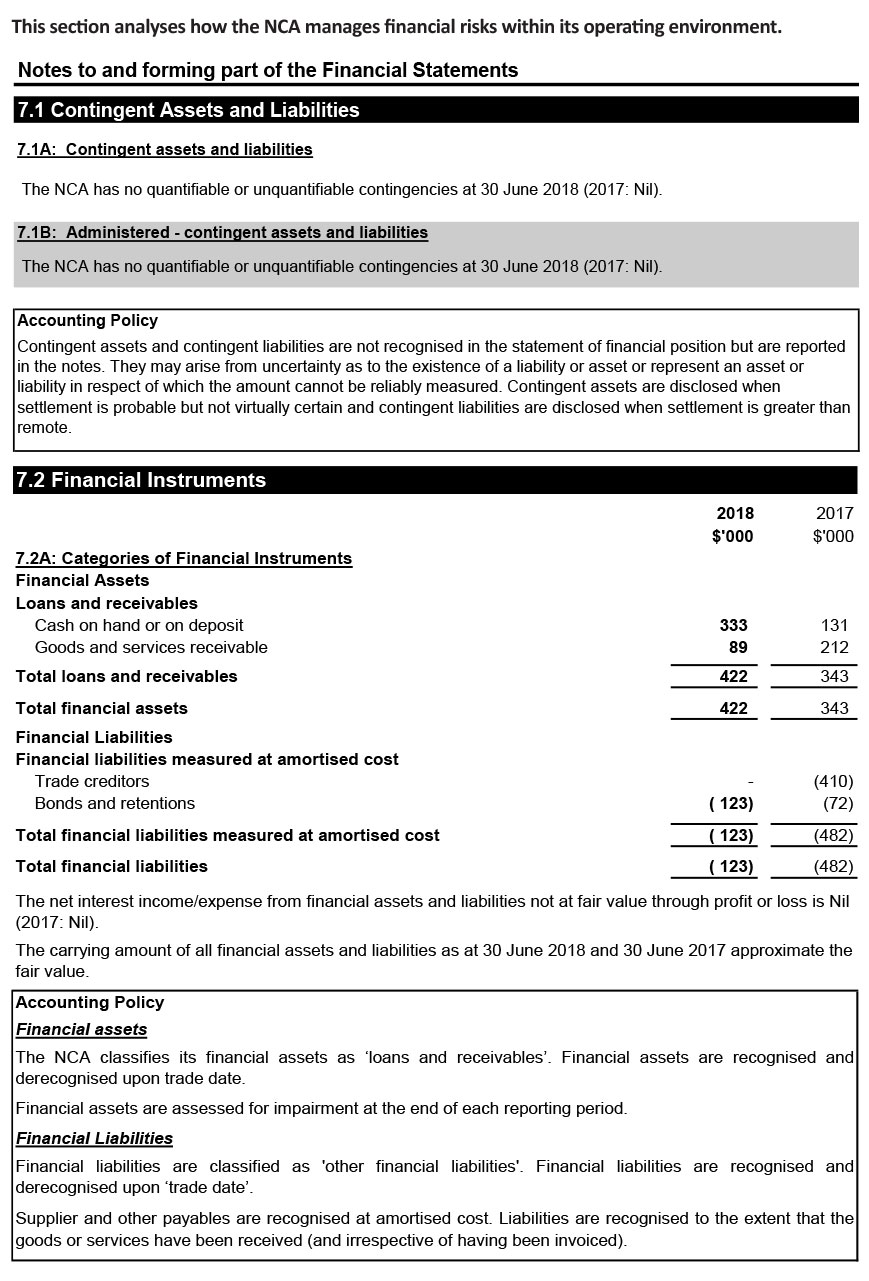

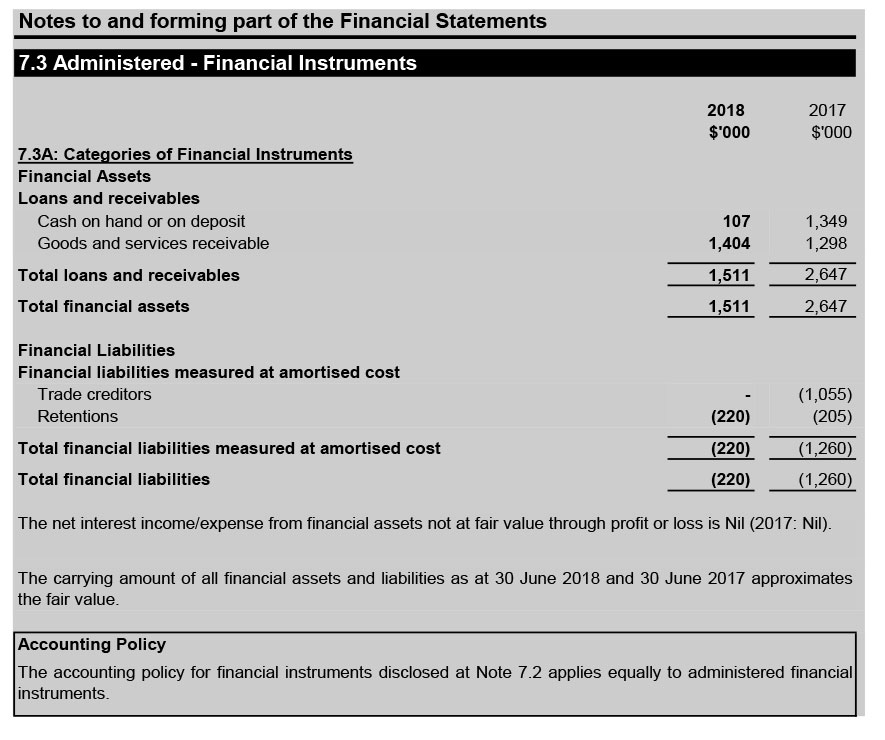

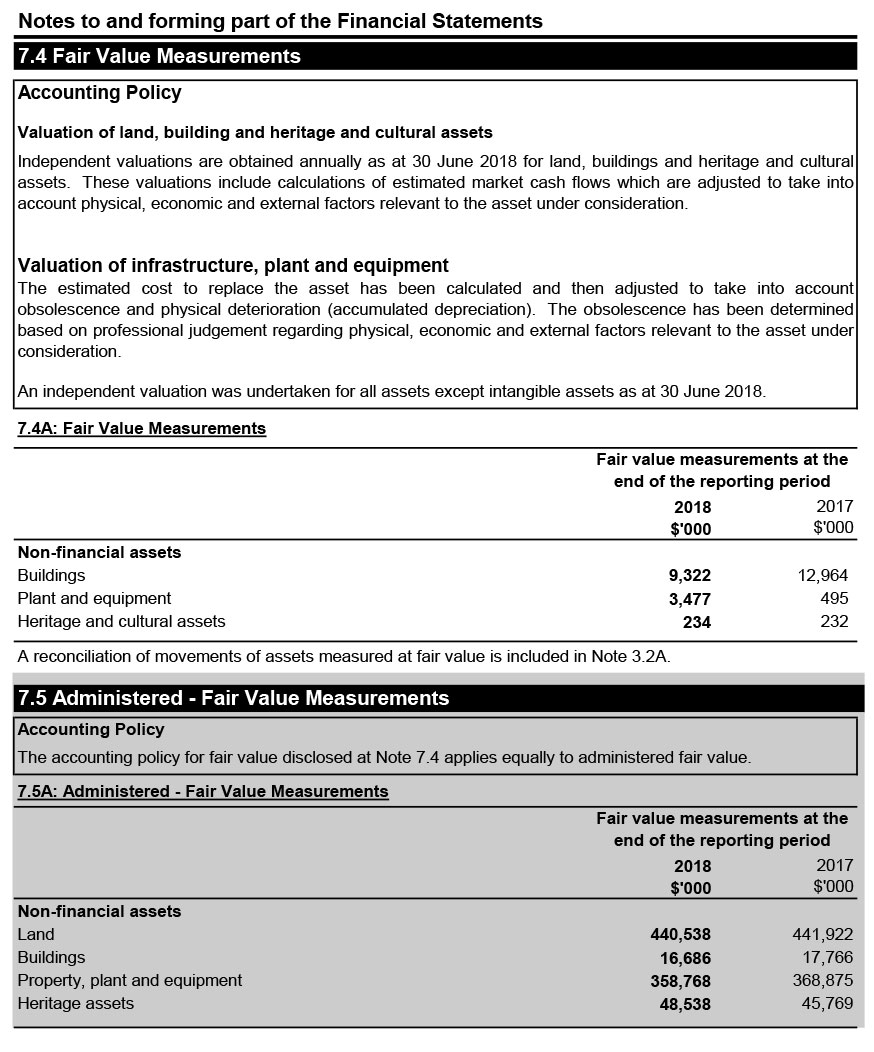

7. Managing Uncertainties

This section analyses how the NCA manages financial risks within its operating environment.

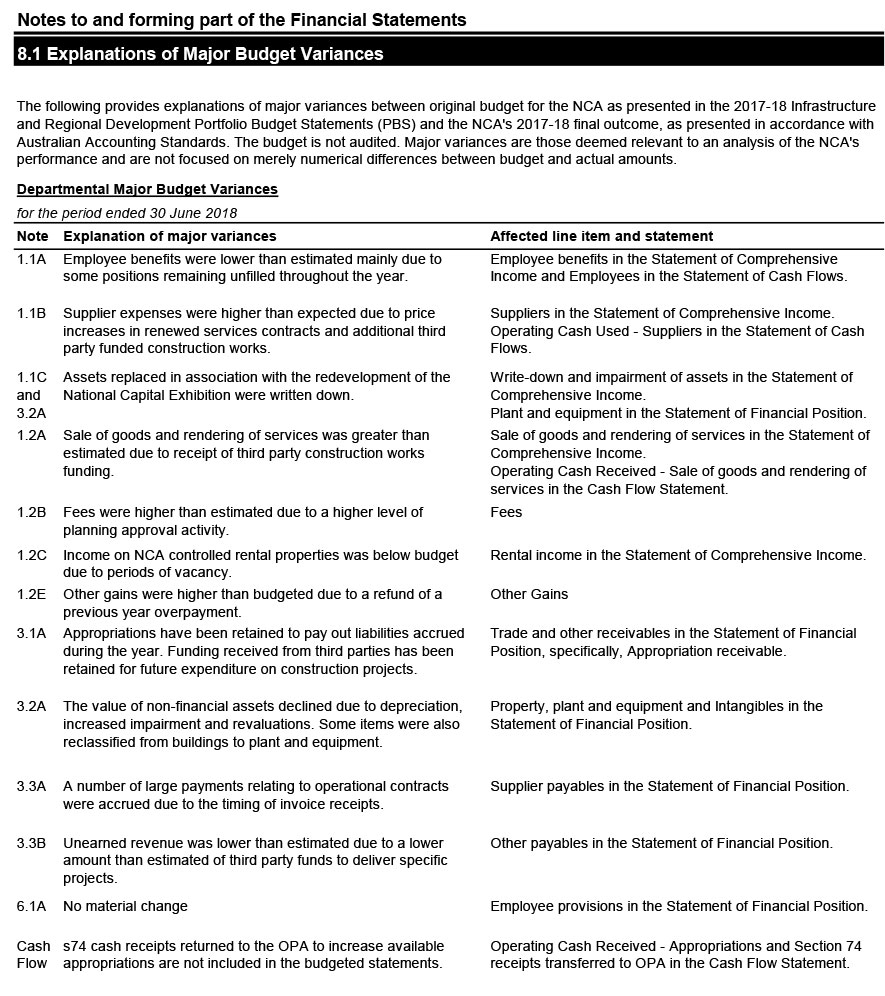

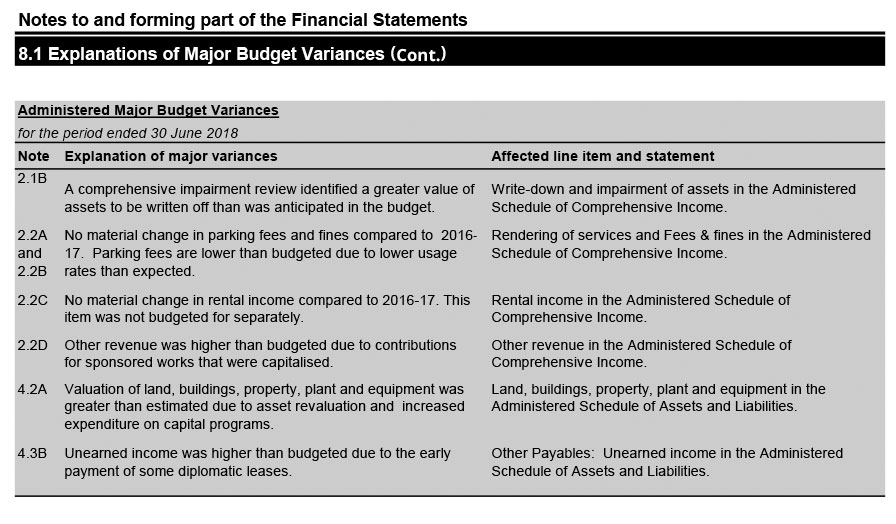

8. Other information